Spacemesh Tokenomics Overview

Cryptocurrencies are all about innovation, and Spacemesh is no exception. At the heart of any successful cryptocurrency lies its Tech and tokenomics—the rules governing how coins are distributed, earned, and circulated. For Spacemesh, its SMH tokenomics are designed to promote fairness, decentralization, and long-term sustainability.

But what exactly makes Spacemesh’s tokenomics stand out? Why does decentralization matter, and how does vesting play a crucial role in the network’s growth? In this post, we’ll break down these concepts in simple, digestible terms.

What is Tokenomics?

Before we zoom in on Spacemesh, let’s get a handle on what tokenomics is in general. Imagine you’re the owner of a bakery. You need to decide how many loaves of bread you’ll bake, how you’ll distribute them, and who gets them. Do you make a lot of bread upfront and give it all away, or do you slowly bake loaves over time so people can always get fresh bread? Tokenomics works the same way for cryptocurrencies, but instead of bread, you have coins.

Tokenomics answers important questions like:

- How many coins will be created?

- How will these coins be distributed?

- What rewards will miners or participants receive?

- How can the economy of this cryptocurrency remain sustainable?

Now that we have a sense of what tokenomics is, let’s dive into Spacemesh.

Spacemesh Tokenomics: Designed for the Long Term

Spacemesh takes a unique approach to distributing its native token, SMH. Unlike some cryptocurrencies that flood the market with tokens, Spacemesh follows a model inspired by Bitcoin—but with important tweaks that make it even more gradual and sustainable.

Why Gradual Issuance?

Instead of dumping a large number of $SMH into the ecosystem at once, Spacemesh releases new coins slowly—similar to how Bitcoin does it, but even slower. Why? This allows the economy to grow steadily, prevents inflation, and ensures there’s always some incentive for new participants to join in and mine SMH.

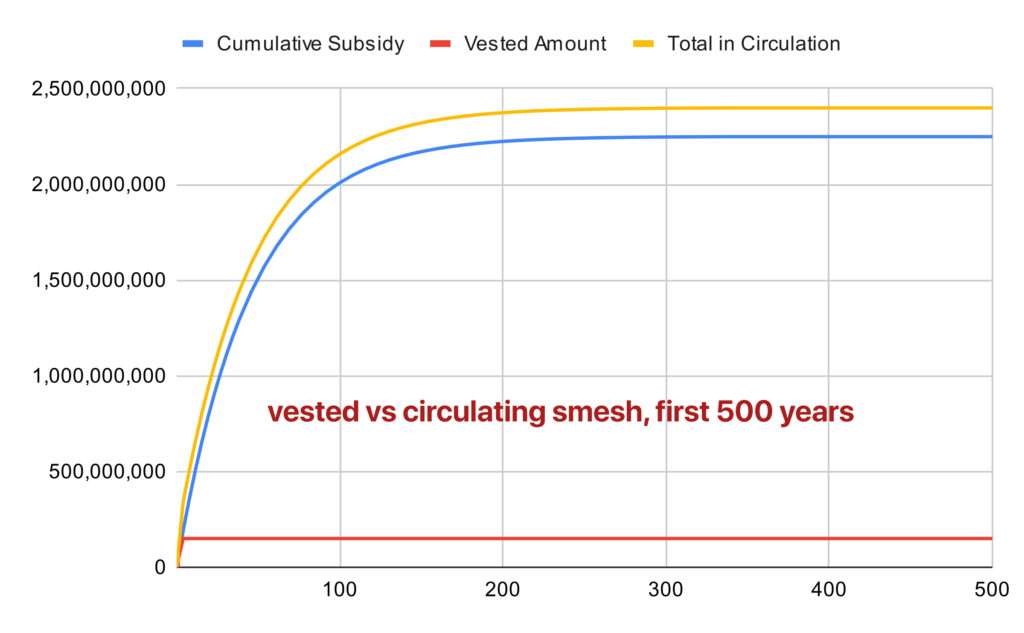

Here’s the fun part: Spacemesh’s issuance rate is 7.3 times more gradual than Bitcoin! To put it simply, Bitcoin cuts the number of new coins it releases every four years in a process called “halving.” But Spacemesh is much more patient. Its issuance decreases steadily with a half-life of 31 years.

Think of it like a slow-release vitamin, giving the network just the right amount of “energy” over time to keep it healthy and growing.

How SMH is Distributed

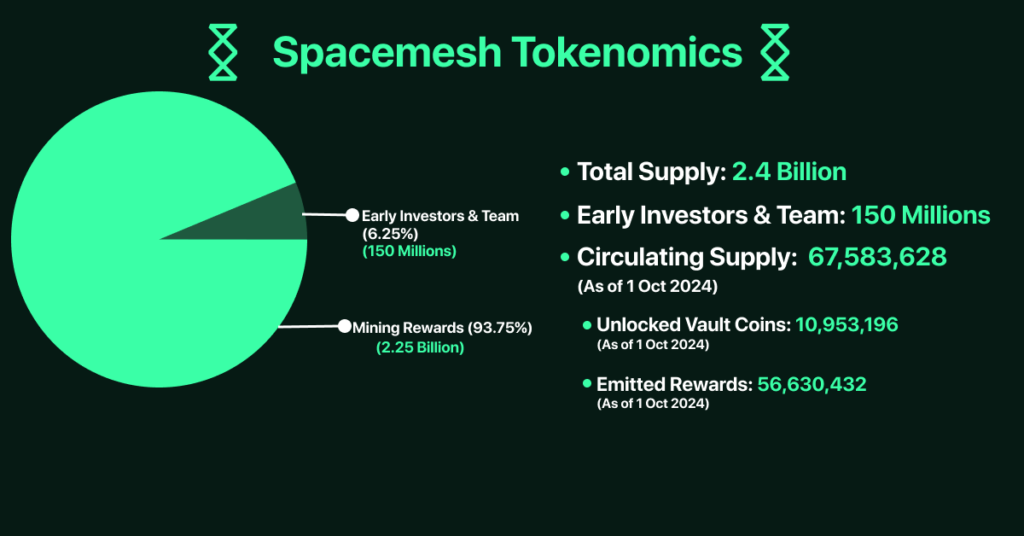

The Total Supply of SMH

Spacemesh has a total supply of 2.4 billion SMH coins. These coins will be distributed slowly over hundreds of years. In fact, the last full SMH won’t be issued until 2299! Talk about thinking long term, right?

But don’t worry—you won’t have to wait until the 23rd century to get your hands on some SMH. Here’s how the distribution works.

No Premine: Starting on Equal Footing

Unlike many cryptocurrencies that give early investors or insiders a huge number of coins before the network even launches, Spacemesh takes a different approach. There is no premine.

What does this mean? On the day the Spacemesh network went live, zero coins was being handed out to early investors or developers. The only way to get SMH in the first year is to mine it yourself, just like everyone else. This helps ensure a fair start for all participants.

Vesting: Slow and Steady Wins the Race

Now, while early investors and builders won’t get coins right away, they are still rewarded over time. This is done through something called a vesting schedule.

What is Vesting?

Think of vesting like this: You’re given a big chocolate cake (or coins in this case), but you’re not allowed to eat the whole thing at once. Instead, you can only eat a slice every year for the next few years. That’s vesting! It ensures that early supporters can’t flood the market with coins all at once, which could cause prices to crash.

How Vesting Works in Spacemesh

For Spacemesh, 150 million SMH coins are set aside for early investors and core team members. These coins will be locked in smart contracts, and they’ll start to unlock after the first year of the network. Over the next three years, these coins will slowly unlock, meaning early supporters will get their share gradually rather than all at once.

Here’s the breakdown:

- Year 1: No coins unlock.

- Years 2-4: Coins unlock gradually, so by the end of year 4, they’ll be fully vested and tradable.

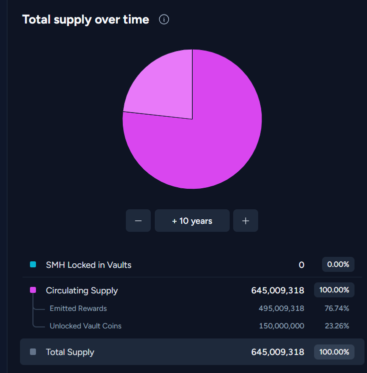

By the 10-year mark, these early coins will represent 25% of the total supply issued up to that point. But over time, as more SMH is mined by the community, this percentage will decrease to 6.25% of the total supply.

You Can Track Vault Unlock Here

Adapting to Community Feedback: Tokenomics Adjustment

One of the standout features of Spacemesh is its commitment to community-driven governance. Unlike some projects where decisions are made behind closed doors, Spacemesh listens to its users and adapts based on their feedback.

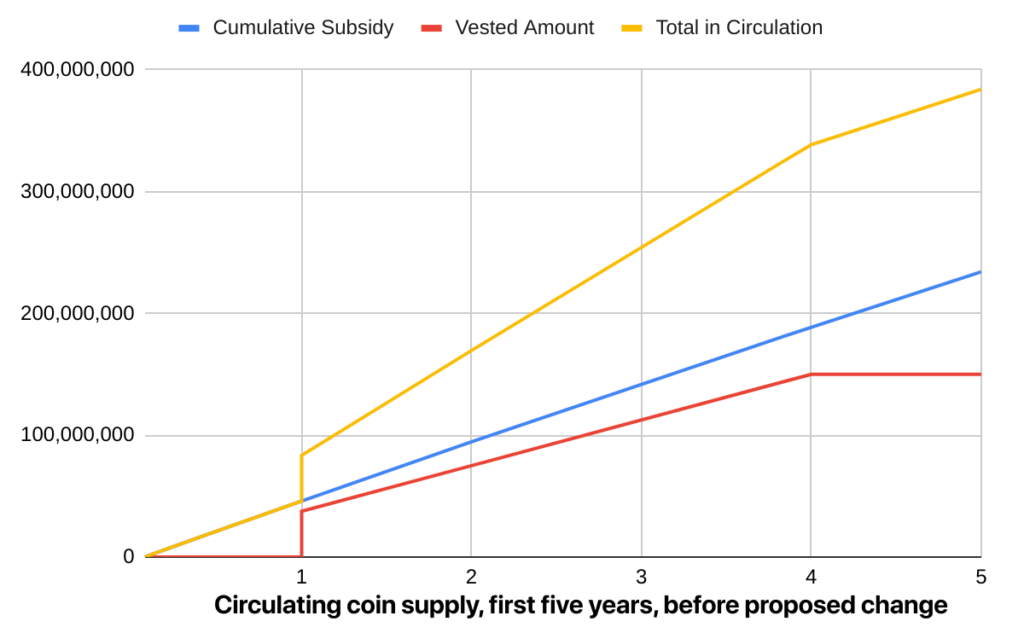

Originally, Spacemesh had a steeper vesting cliff. What does that mean? It means that after the first year, a large portion of the tokens reserved for early investors and supporters would unlock all at once. This would have caused a sudden increase in the circulating supply, which raised concerns within the community.

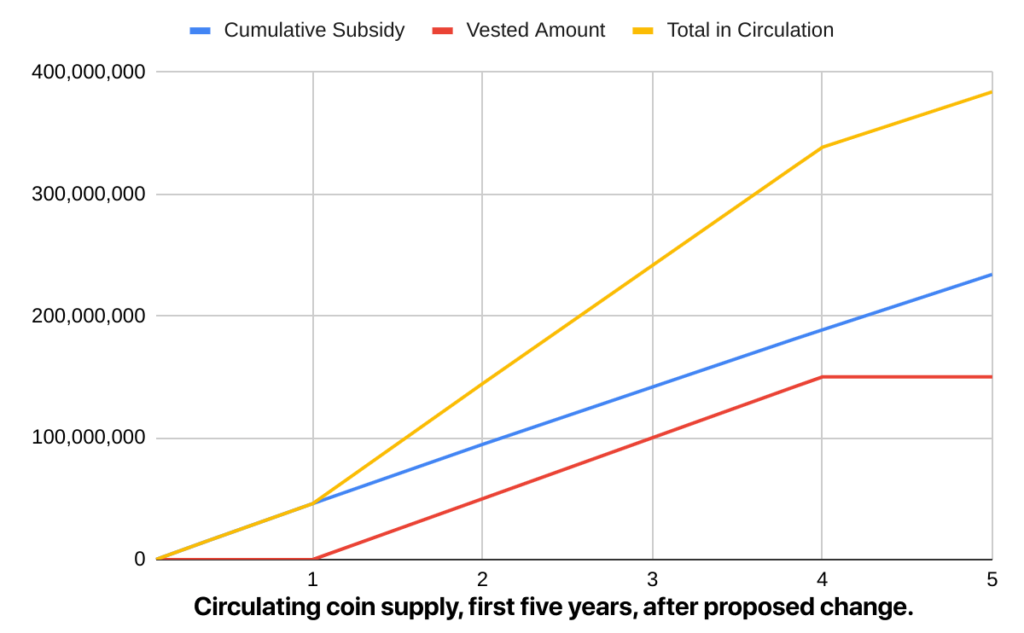

To address this, the Spacemesh team listened to the community and smoothed out the vesting schedule. Instead of a sharp release of tokens, the coins now unlock gradually, reducing the risk of a supply shock that could destabilize the market.

This change shows Spacemesh’s commitment to fairness and maintaining a healthy ecosystem. By responding to community concerns, they ensured the network remains stable, and early supporters still get rewarded without disrupting the broader market.

Why This Matters

This adjustment highlights an important aspect of Spacemesh’s tokenomics: it’s built to evolve with the community. Instead of sticking to rigid rules, the team worked with the community to find a better solution. This kind of adaptive governance helps ensure long-term sustainability and keeps the project aligned with the interests of all participants.

A Long-Term Vision: Decentralization and Fairness

Spacemesh’s tokenomics are built with decentralization in mind. The team believes that anyone, anywhere, should be able to participate in mining without needing specialized hardware. In fact, all you need is a regular computer and some extra storage space to start earning SMH.

This makes the network more inclusive, allowing people from all over the world to join without expensive mining rigs. It’s a bit like saying: “Hey, you don’t need a fancy bakery to make great bread—just your home kitchen will do!

A Predictable Economic Model

One of the key goals of Spacemesh’s tokenomics is to create an economy that’s predictable and transparent. Since the rate at which SMH is issued is tied to an exponential decay function, the supply is always known and easy to calculate.

In other words, there are no surprises. Everyone can see how many SMH coins have been issued at any given time, and how many are left to be mined.

Why Does This Matter?

At its core, the way Spacemesh is handling its tokenomics and vesting schedule is about ensuring fairness and long-term sustainability. Instead of handing early investors a huge bag of coins upfront, Spacemesh ensures that they receive their rewards over time. This keeps the market stable and gives new participants a chance to mine and earn coins fairly.

The gradual issuance also ensures that there will always be new coins for miners to earn, even many years into the future. It’s a plan designed not just for now, but for centuries to come. That’s long-term thinking!

Conclusion: Building a Decentralized Future

Spacemesh’s approach to tokenomics and vesting is all about creating a fair and decentralized economic model that lasts for generations. By allowing anyone with a computer to mine SMH and by issuing coins gradually, Spacemesh is making sure the network remains healthy, inclusive, and sustainable.

The slow-release nature of SMH ensures that new participants always have something to mine, while the vesting schedule for early investors keeps the market balanced.

So, whether you’re a miner, developer, or investor, Spacemesh is giving you the opportunity to be part of a decentralized future. And it’s doing so with fairness, transparency, and sustainability at the heart of its economic model.

Resources

- Smoothing Out the Spacemesh Vesting Schedule

- Announcing the Spacemesh Economic Model

- A website where you can visually and interactively explore

- If you have any questions, join the amazing Spacemesh Discord Community.

- Spacemesh Dashboard